All Categories

Featured

Table of Contents

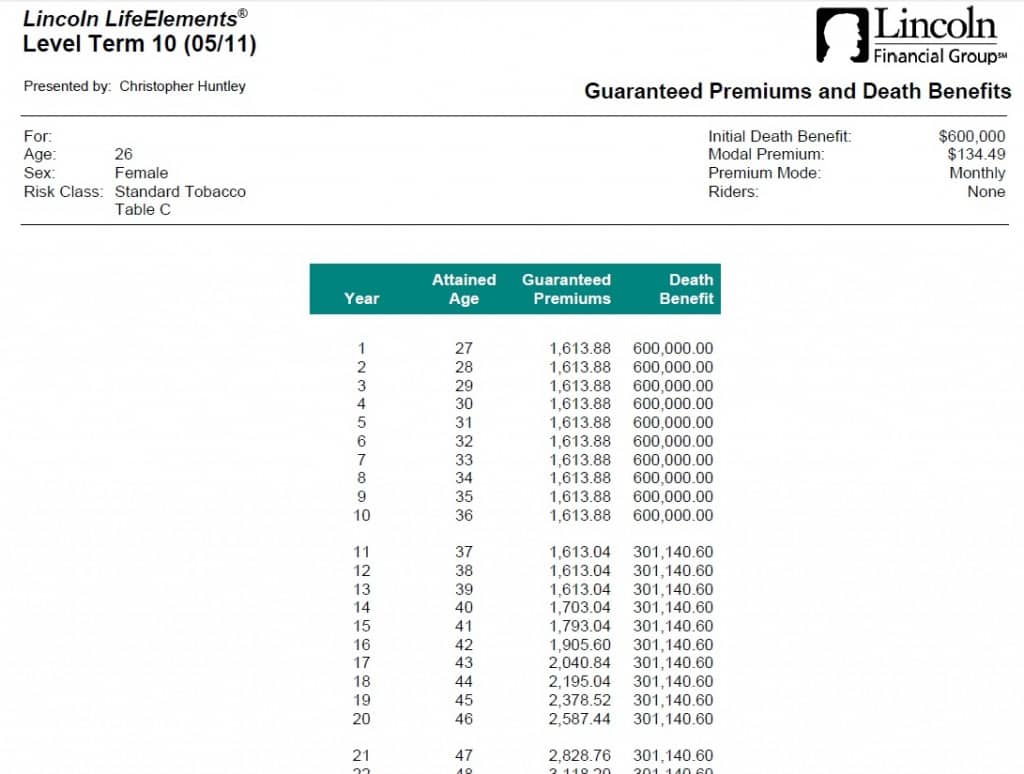

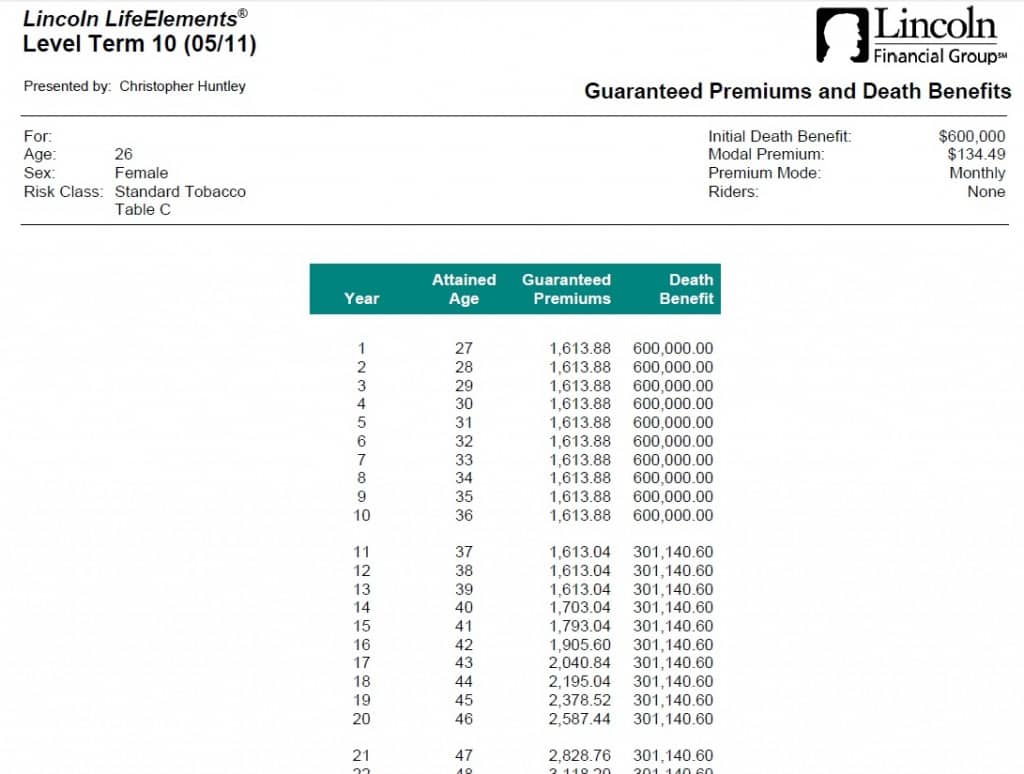

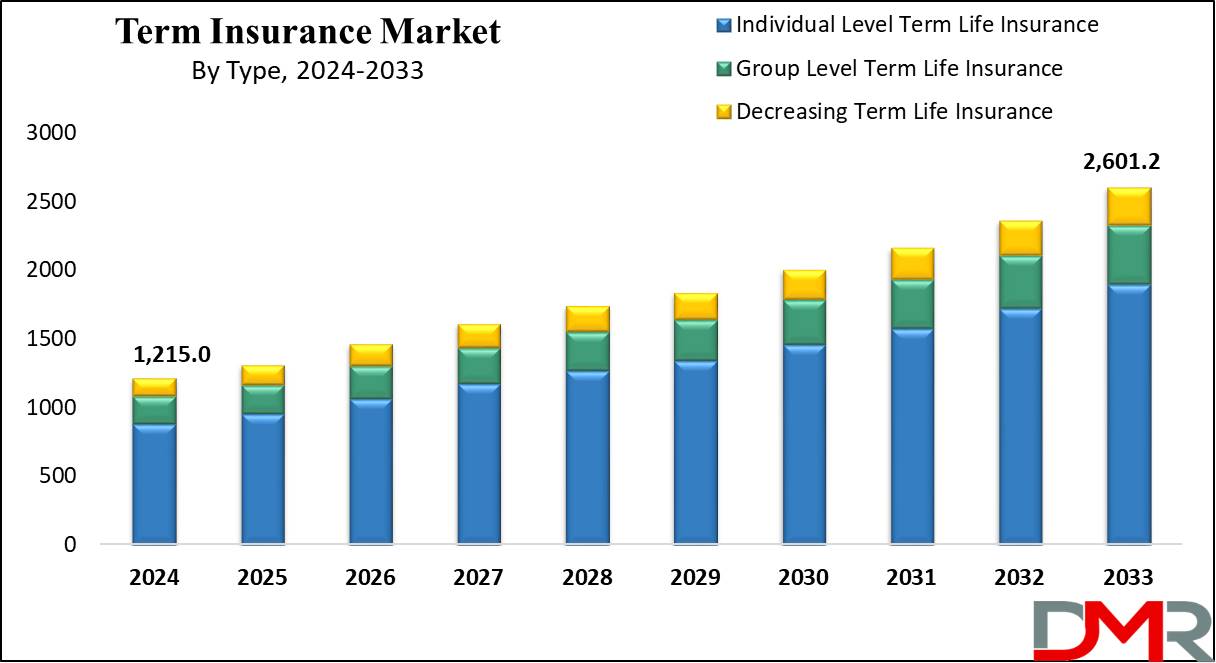

A degree term life insurance policy policy can provide you tranquility of mind that the individuals who rely on you will have a death benefit during the years that you are planning to support them. It's a means to help look after them in the future, today. A degree term life insurance policy (sometimes called level premium term life insurance) plan gives protection for an established number of years (e.g., 10 or 20 years) while keeping the costs settlements the same for the period of the policy.

With degree term insurance policy, the expense of the insurance policy will certainly stay the same (or potentially reduce if rewards are paid) over the term of your policy, normally 10 or 20 years. Unlike long-term life insurance policy, which never runs out as lengthy as you pay premiums, a degree term life insurance policy plan will end at some factor in the future, generally at the end of the period of your level term.

What is the Function of Term Life Insurance With Accidental Death Benefit?

Due to this, lots of people utilize permanent insurance coverage as a steady monetary planning tool that can offer lots of requirements. You might have the ability to transform some, or all, of your term insurance during a set duration, usually the very first ten years of your plan, without requiring to re-qualify for insurance coverage also if your health has actually altered.

As it does, you may intend to include in your insurance protection in the future. When you initially get insurance coverage, you may have little financial savings and a big mortgage. At some point, your financial savings will grow and your home loan will shrink. As this happens, you may desire to eventually minimize your death advantage or think about converting your term insurance to an irreversible policy.

Long as you pay your costs, you can rest very easy recognizing that your liked ones will certainly obtain a death advantage if you die throughout the term. Several term plans enable you the ability to convert to long-term insurance policy without needing to take one more health examination. This can allow you to take benefit of the added advantages of a permanent plan.

Degree term life insurance policy is one of the easiest paths into life insurance, we'll review the advantages and downsides to make sure that you can pick a strategy to fit your needs. Level term life insurance policy is one of the most typical and fundamental form of term life. When you're looking for temporary life insurance coverage strategies, level term life insurance policy is one route that you can go.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

You'll load out an application that contains basic individual information such as your name, age, etc as well as a much more thorough set of questions about your medical background.

The short solution is no. A degree term life insurance coverage plan does not build cash money worth. If you're looking to have a policy that you're able to withdraw or obtain from, you may explore permanent life insurance. Whole life insurance policy plans, for instance, let you have the comfort of fatality advantages and can build up cash money value in time, meaning you'll have a lot more control over your advantages while you're active.

The Meaning of Short Term Life Insurance

Motorcyclists are optional provisions added to your plan that can offer you fringe benefits and defenses. Cyclists are an excellent means to include safeguards to your policy. Anything can take place throughout your life insurance policy term, and you intend to be ready for anything. By paying simply a bit much more a month, bikers can offer the assistance you require in instance of an emergency.

There are instances where these advantages are developed right into your plan, however they can additionally be offered as a separate addition that requires added settlement.

Latest Posts

Final Expense Policy

Burial Insurance Nj

Expenses Of Insurance Companies